CPP Trader's Master Group - Week #3

- CPP Trading

- Jan 26, 2024

- 1 min read

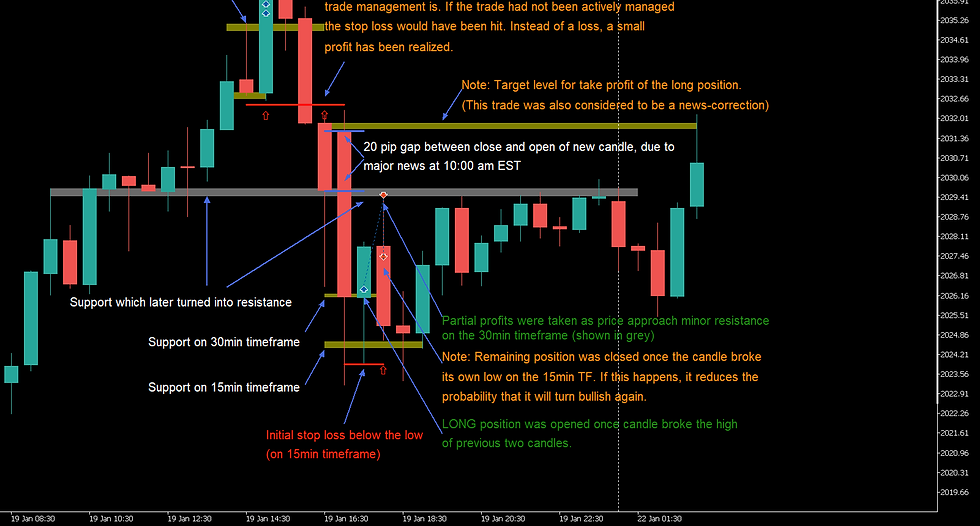

Below is a chart with two trades taken on XAU/USD on the 15 min timeframe on January 19.

The first trade was a long position that had been scaled into with two entries. Once bullish confirmation was present, an upward move was anticipated to retest the next higher resistance, which had been formed three days prior. The first candle after the trade was opened closed bullish but weak (small body with a large wick). Risk was mitigated through active trade management, and both positions were closed with a small profit.

The second trade was expected to correct the price movement from a recent news event, but the bulls weren't strong enough, and the price rejected a resistance, as shown on the 30-minute timeframe in the chart below.

We can see that after the resistance was rejected, the market reversed and later moved up to the resistance again. Eventually, it broke above and hit the original target level as anticipated.

Comments